UFI has released the 36th edition of its flagship Global Exhibition Barometer report. The Global Association of the Exhibition Industry new edition of its report offers fresh insights into the current state of the exhibition industry which show continued industry-wide adaptation and a drive to enhance event formats.

The results show a positive trend in activity in respondents’ home countries, with 47% reporting an increase of more than 5% in 2025.

In terms of operating profits, 31% of companies report annual growth of more than 10% for 2025, and 33% forecast similar increases for 2026.

Global AI adoption in the exhibition industry is steadily increasing, with 87% of companies now reporting the use of AI – a 4% increase from six months earlier.

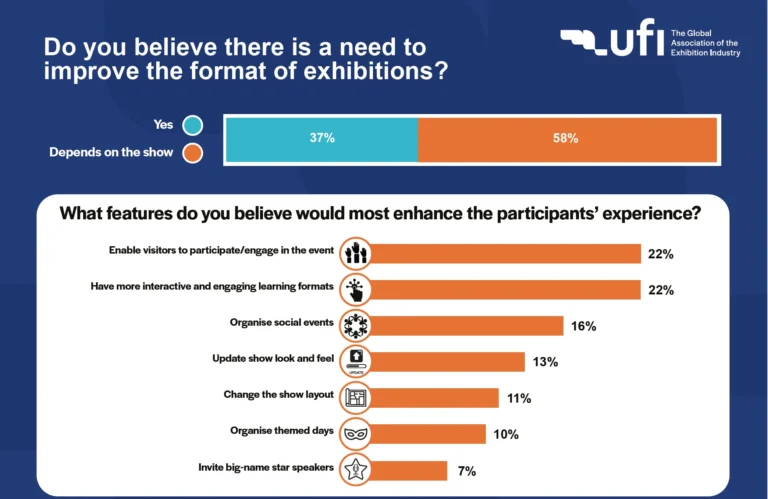

Regarding event formats, 37% of survey participants believe all events need improvement overall, while another 58% say it depends on the type of show.

“This edition of the Global Exhibition Barometer confirms what we are seeing across the industry: strong, steady growth and a sector that continues to adapt at pace. We see solid growth in rented space and operating profits across many markets, alongside a notable acceleration in the use of AI to improve efficiency and customer experience,” commented Chris Skeith OBE, managing director and CEO at UFI.

“At the same time, the call for more engaging and interactive event formats highlights the industry’s ongoing focus on enhancing value for participants. These insights will support organisations as they update their strategies and continue to navigate an environment that remains dynamic and diverse across regions.”

Size and scope

This latest edition of UFI’s bi-annual industry report was concluded in December 2025 and is based on data from 378 companies in 57 countries and regions. The study includes outlooks and analyses for 19 focus countries and regions – Argentina, Australia, Brazil, China, Colombia, France, Germany, Greece, India, Italy, Malaysia, Mexico, South Africa, Spain, Thailand, Türkiye, the UAE, the UK, and the USA – as well as five additional aggregated regional zones. It also segments global results for organisers, venues and service providers/suppliers whenever this is relevant.

Rented space

Globally, 47% of respondents report an increase in activity of more than 5% in their country in 2025, while 42% say it remained stable (+/-5%). Only 10% declare a decrease of more than 5%.

The forecast for 2026 is similar to the 2025 results, with 44% expecting an increase in activity of more than 5%, 41% believing it will remain stable, only 8% expecting a decrease of more than 5%, and 7% are uncertain.

Revenues

Global results indicate that most companies foresee:

An increase of more than 5% of their revenues in 2025 compared to 2024 for “Renting space” (34% of respondents) and “Selling services” (39%).

A stable evolution (of +/- 5%) for “Selling sponsoring opportunities” (34% of respondents, while 24% of respondents mention that this revenue stream is not relevant for their company).

50% of respondents do not consider “receiving subsidies” relevant to their company. When it is, most anticipate a stable evolution (+/- 5%) of this revenue stream.

Operating profit

In terms of operating profits for 2025, 31% of the companies report an annual increase of more than 10%, and 57% declare a stable result (between -10% and +10%). For 2026, 33% of the companies forecast an annual increase of more than 10%, and 58% report a stable profit.

Workforce development

Globally, 39% of companies declare that they plan to increase their staff numbers, while another 57% declare that they will keep current staff levels stable.

Most important business issues

For the short term:

The most pressing business issue remains “State of the economy in home market” (19% of answers globally, unchanged from six months ago), and it is the main issue in all regions, except the Middle East and Africa, where it ranks second.

“Global economic developments” (16% of answers, +1% compared to six months ago, and the top issue with 20% of answers for the Middle East and Africa) and “Geopolitical challenges” (16%, same as six months ago) come in as the second and third most important issues globally.

“Competition from within the exhibition industry” (12%, +2% compared to six months ago), “Internal management challenges” (11%, -2% compared to six months ago), followed by “Impact of digitalisation” (9%, same as six months ago), “Regulatory / Stakeholders issues” (6%), “Sustainability/Climate” and “Competition with other media” (both 5%) follow.

For the mid-term, there are many differences in the ranking of the most important issues compared with the short term:

The top four issues remain the same, but in different order: “Global economic developments” is the top mid-term issue with 20% of answers (compared to the short-term issues, where it ranks second with 16%), followed by “Geopolitical challenges” with 16% of answers (same share as in the short term) and “State of the economy in the home market” is third with 13% of answers (compared to the short-term issues, where it ranks first with 19%). “Competition from within the exhibition industry” comes to the fourth position for both short-term (12% of answers) and mid-term (11%).

“Sustainability/Climate” (10% of answers), “Impact of digitalisation” (9%), “Competition with other media”, “Regulatory stakeholders’ issues” and “Internal management challenges” follow (all with 7%).

Globally, 68% of companies indicate that they currently use standard AI tools in at least some of their business functions. In addition, 15% have AI-powered tools integrated into their existing systems, and 4% have already developed proprietary algorithms trained on internal data. Overall, 87% of companies are now using AI (+4% compared to six months ago).

In parallel, 13% of respondents declare having no or almost no use of AI at this stage (-4% compared to six months ago).

In terms of their level of maturity, most companies are still researching or testing solutions in the three domains surveyed:

- 79% towards “improving company and process efficiency”

- 70% towards “improving customer experience”

- 57% towards “generating revenues using AI-powered products”.

New format of events

Results indicate that while only 37% of respondents see a definite need to update the format overall, an additional 58% consider it depends on the type of show. Only 6% believe no changes are needed.

While a majority of companies from all segments state that the need to improve the format of events “depends on the show”, it’s interesting to notice the different proportions: seven companies out of 10 among venues, six out of 10 for organisers, and five out of 10 for service providers/suppliers.

When looking at what improvements matter most, respondents emphasise interactivity and engagement above all. The top two priorities – each selected by 22% – are “Enabling visitors to participate/engage in the event (in product demonstrations/competitions, “gamification”, etc.)” and “Having more interactive and engaging learning formats (possibly including formal recognition, as part of individual professional development)”.

“Organising social events” also ranks highly, with 16% supporting creating additional experiences at the event venue or in special places. “Updating show look and feel (sounds, lights, and signage)” follows at 13%, alongside “Changing the show layout (thematic sections, etc.)” (11%) and “Organising themed days (for multi-day events)” (10%). “Inviting big-name star speakers”, while appreciated, is seen as a relatively lower-impact enhancement (7%).

The 36th Global Exhibition Barometer report was conducted in collaboration with 33 associations.The entire exhibition industry, the full results can be downloaded at www.ufi.org/knowledge-hub.

The next UFI Global Exhibition Barometer survey will be conducted in June 2026.

Source: www.exhibitionworld.co.uk

Comments are closed.